The following analysis of select counties of the Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The most recent jobs data showed that by February of this year Colorado had recouped all of the more than 375,000 jobs that were shed due to the pandemic and had added an additional 6,000 positions. The recovery in employment was faster than I had expected, which has led me to revise my 2022 forecast: I now predict that the Colorado job market will increase by 4% this year and will add more than 112,000 new jobs. The state unemployment rate in February was 4%, which is well below the pandemic peak of 11.8% but still above the 2.6% average in 2019. Regionally, unemployment rates ranged from a low of 3.1% in Boulder to a high of 4% in the Colorado Springs and Greeley metropolitan areas.

Colorado Home Sales

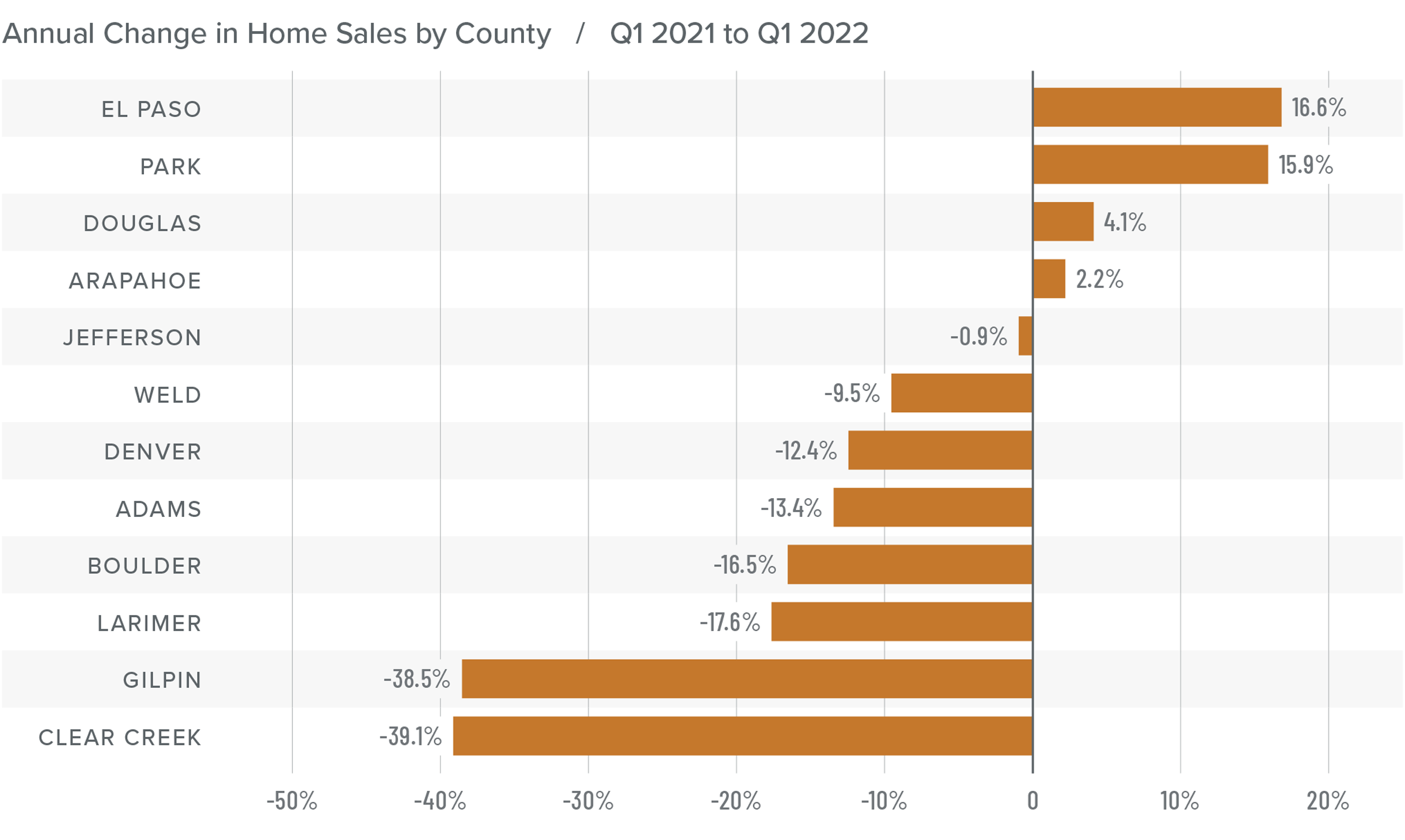

❱ In the first quarter of the year, 8,178 homes sold, representing a drop of 6.3% compared to the same period a year ago and 30% lower than in the fourth quarter of 2021.

❱ Sales increased in 4 of the 12 counties covered by this report but fell in the balance of the market areas.

❱ Similar to last quarter, low inventory levels continue to constrict sales. Listing activity was 17.3% lower than the same period in 2021 and 29.5% lower than in the fourth quarter of 2021.

❱ Pending sales, which are an indicator of future closings, also declined, though the drop of 4.3% is not that significant. That said, unless we see a surge in inventory levels in the spring, second quarter sales may also be light.

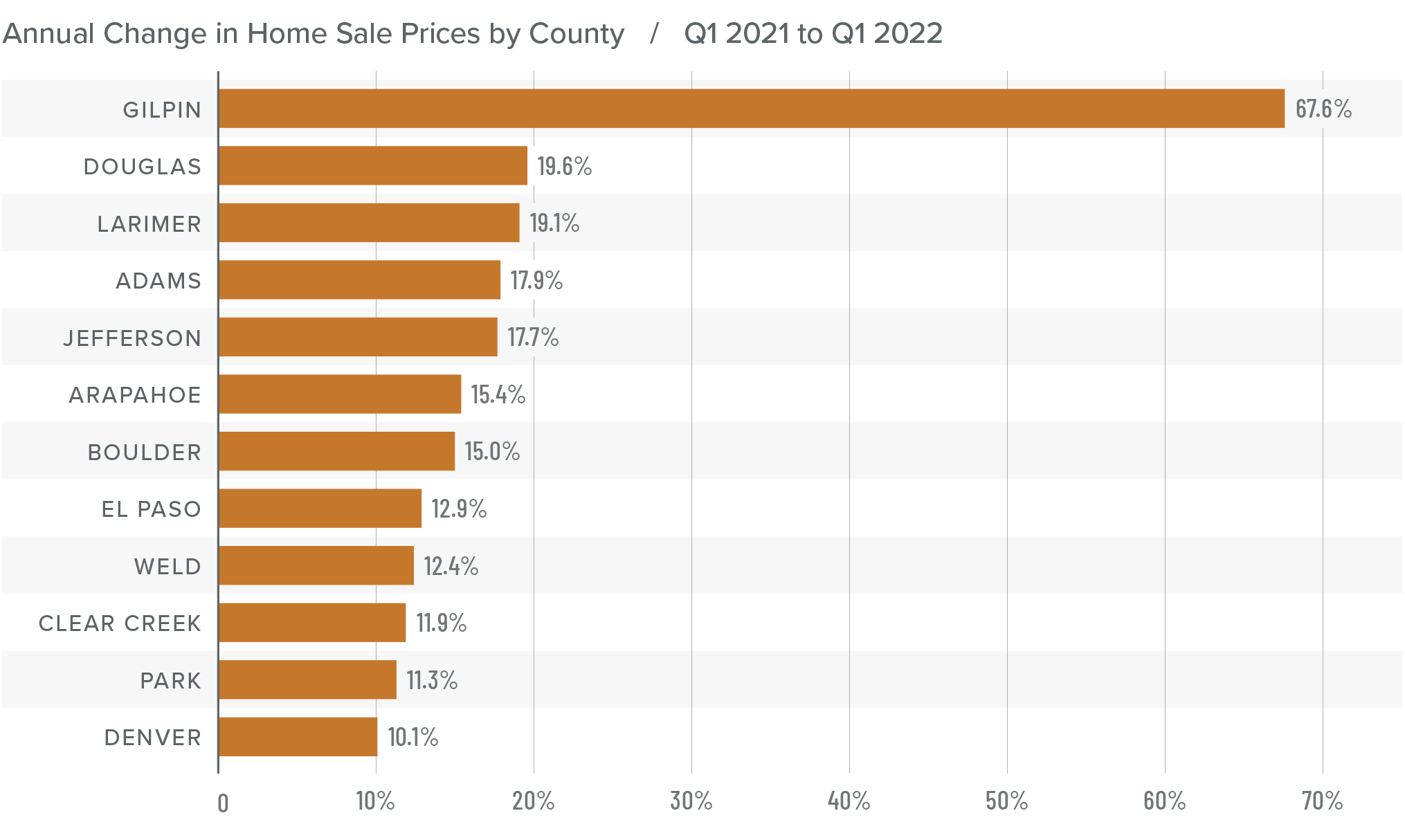

Colorado Home Prices

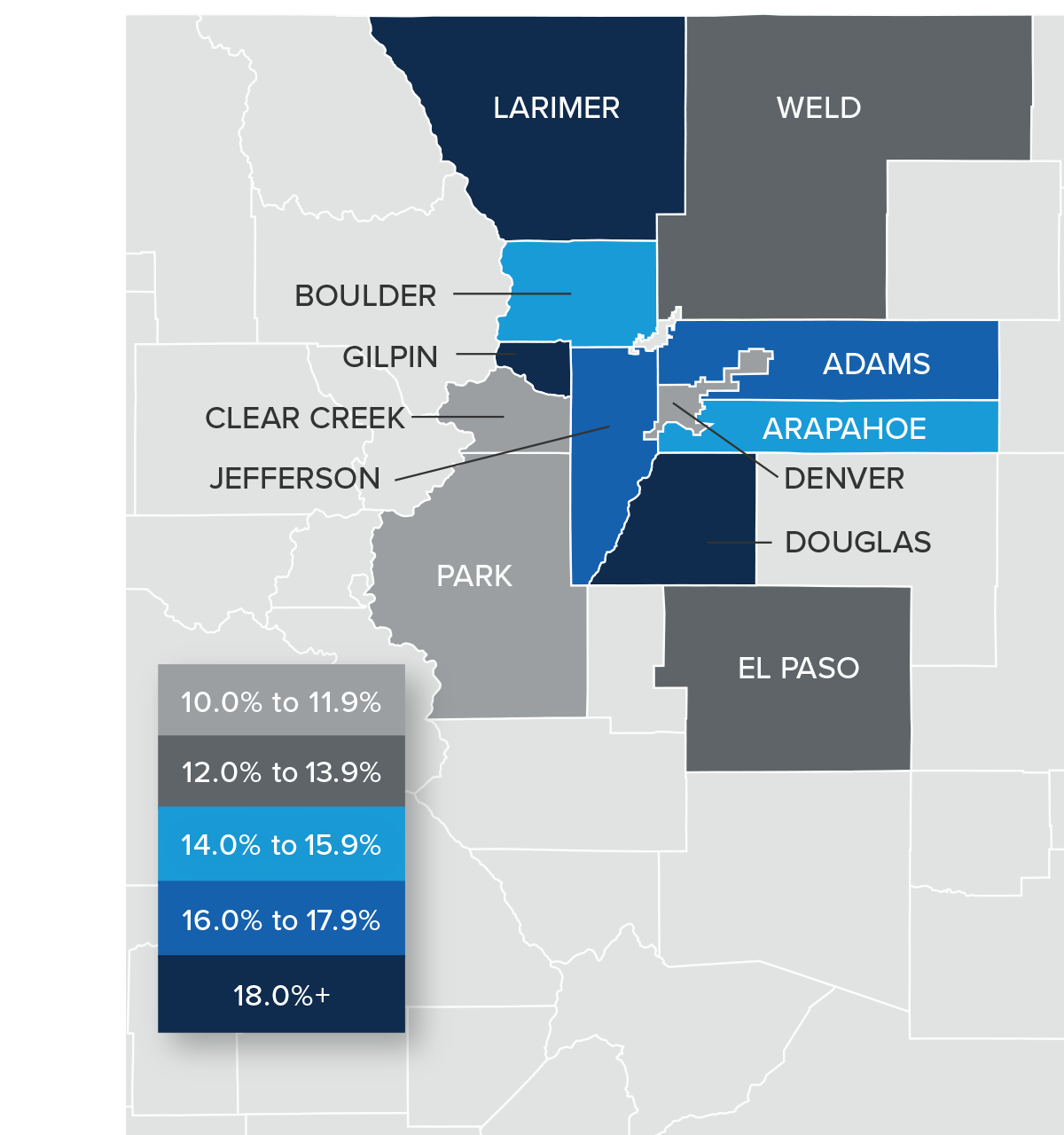

❱ With limited inventory and rising mortgage rates, buyers were motivated, as demonstrated by the 14.9% increase in average prices compared to a year ago. Home prices in first quarter averaged $637,963, which is 4.5% higher than last quarter.

❱ Boulder County continues to see average sale prices holding above $1 million. Although we have seen some softening in list prices, I expect this market to remain above the $1 million mark as we move through the year.

❱ Year over year, prices rose by double-digits across all markets covered by this report, with a huge jump in the small Gilpin market.

❱ With little in the way of choice for buyers—as well as a “fear of missing out” given rising mortgage rates—it’s no surprise there was such solid price appreciation. That said, there is normally a lag between rising rates and any impact on home prices. The second quarter should indicate if the jump in rates has had a softening effect on price growth.

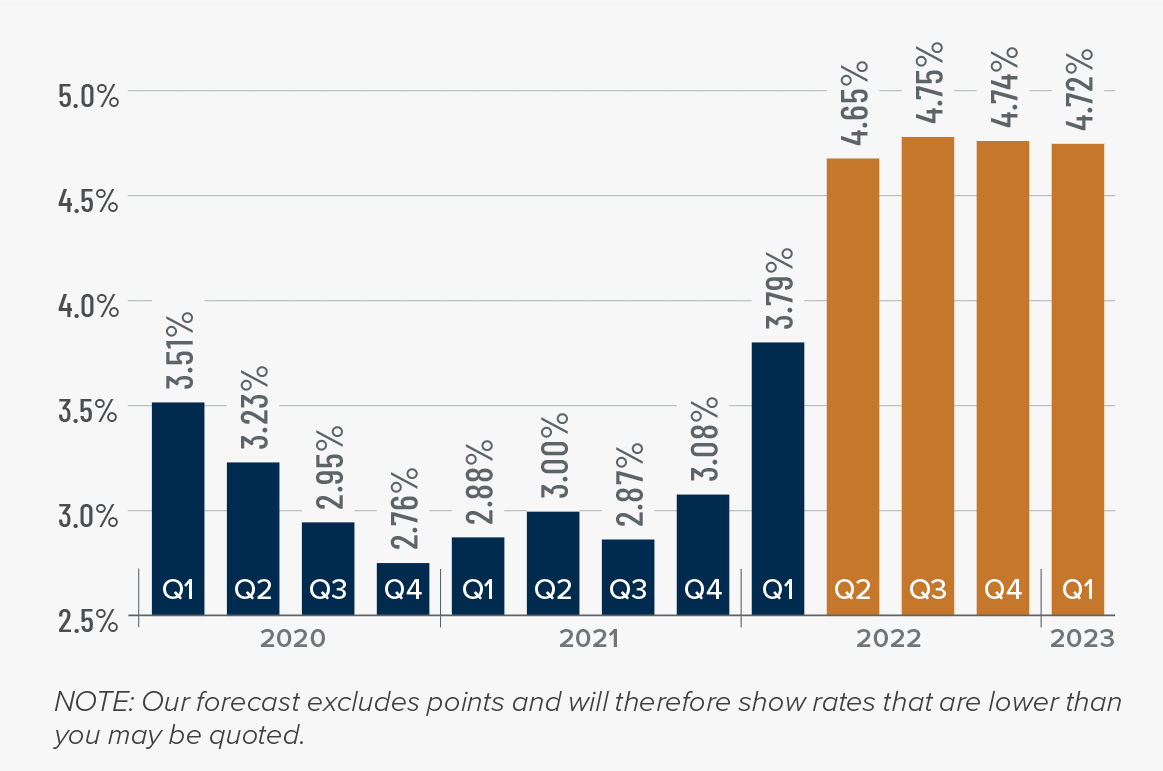

Mortgage Rates

Average rates for a 30-year conforming mortgage were 3.11% at the end of 2021, but since then have jumped over 1.5%—the largest increase since 1987. The surge in rates is because the market is anticipating a seven- to eight-point increase from the Federal Reserve later this year.

Because the mortgage market has priced this into the rates they are offering today, my forecast suggests that we are getting close to a ceiling in rates, and it is my belief that they will rise modestly in the second quarter before stabilizing for the balance of the year.

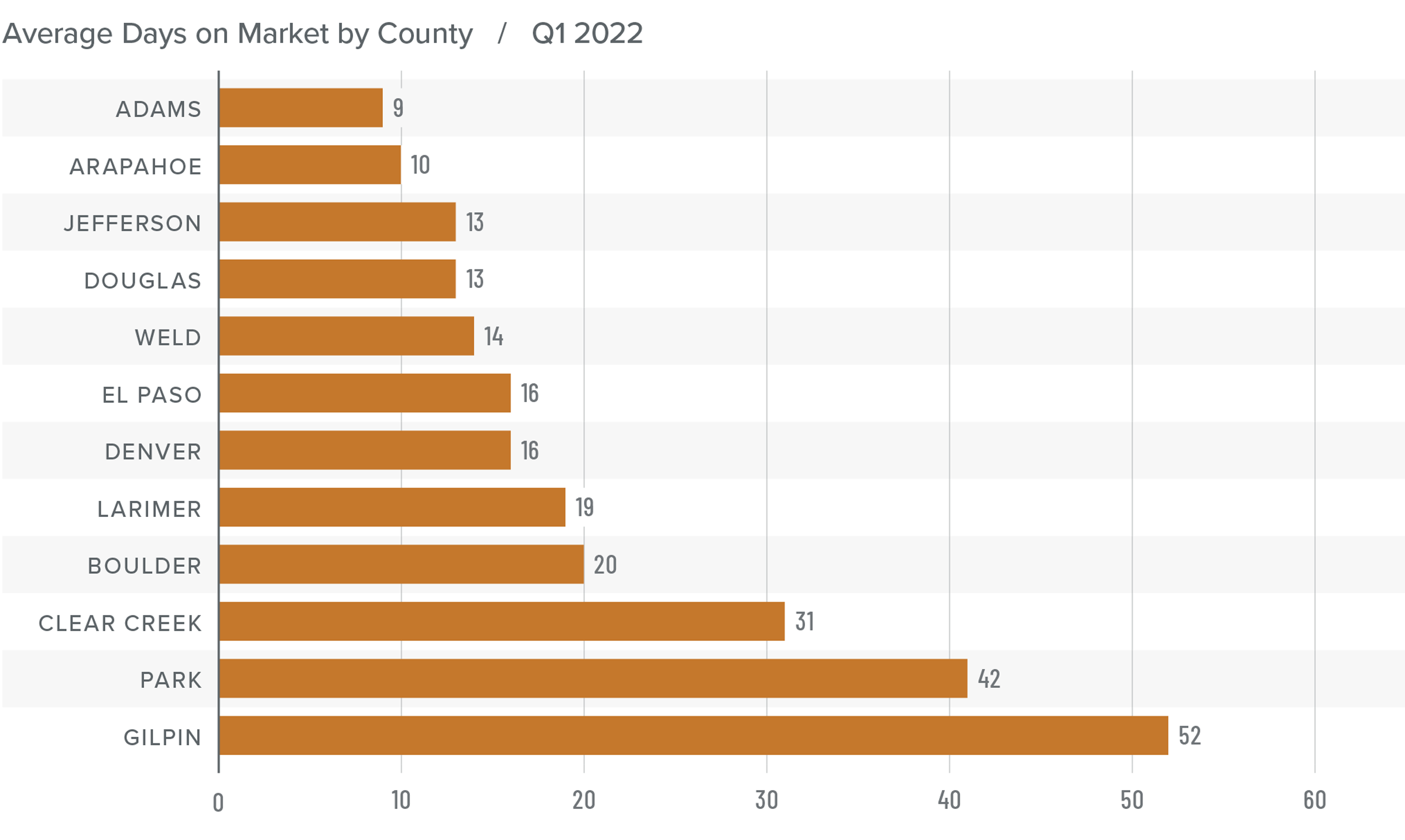

Colorado Days on Market

❱ The average number of days it took to sell a home in the markets contained in this report fell four days compared to the first quarter of 2021.

❱ The length of time it took to sell a home dropped in every county other than Gilpin compared to the same quarter a year ago.

❱ It took an average of only 21 days to sell a home in the region, matching the previous quarter.

❱ Compared to the final quarter of 2021, average market time fell in Clear Creek, Adams, Denver, Jefferson, and Arapahoe counties, but rose in the balance of the markets contained in this report.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

With Colorado on solid economic footing, I expect housing demand to remain strong even in the face of rising financing costs. Inventory levels remain very low, and new home construction has not expanded enough to meet demand, which continues to put upward price pressure on resale homes. The market appears to have shrugged off the jump in mortgage rates in the first quarter, but the full effects won’t be felt until later this spring. We’ll have to wait and see what impact, if any, there will be, but data on listing prices shows that home sellers remain bullish.

Given all these factors, I am leaving the needle in the same position as last quarter. The market clearly still favors sellers, but we need a few more months of information to determine how rising mortgage rates may impact home sales and/ or prices.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link